Jared Allen Structures an Overconfident Deal

The details of the Jared Allen deal leaked out not too long ago, and he (along with his agent, Ken Harris of Optimum Sports Management) seems to have structured the deal in a way that’s extremely optimistic about his likelihood of landing a new contract.

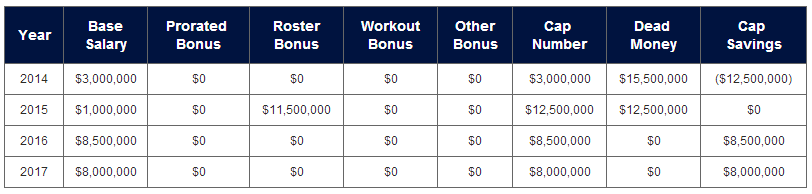

In many ways, it’s a “team-friendly” deal. The first two years are fully guaranteed, and he only has a base salary of $3,000,000 in the first year. After that, his base salary drops to $1,000,000 but he has a fully guaranteed roster bonus of $11,500,000. In effect, they’ll have him for two years at $16,500,000 but bear the brunt of the cap hit in the second year.

Jared really hurt himself with this deal.

After the first two years, there are no guarantees for his remaining salary ($8,000,000 and $8,500,000) and he can be cut by the Bears at any time at no cost (cap-wise) to the organization. If he is cut in 2015, the Bears suffer a $12,500,000 cap hit and therefore will zero out any contribution to the cap they would otherwise save by cutting him (meaning no savings if they cut him).

Because there’s no signing bonus, there’s no prorated cap that the Bears will have to watch out for if they cut him after the second year, or if they use a post-June 1st designation.

From overthecap.com

Most curiously, however, is a provision in his contract that voids his final year (2017) if he has a 12+ sack season in any of his three first years in order for Allen to take advantage of the new cap number in 2017, which could be upwards of $170,000,000 (this void takes place after June 1st).

That is, Allen thinks he can earn more than $8,000,000 with teams in 2017 should he hit 12 or more sacks in a previous year, especially in a free agent market well after the draft.

Jared Allen will be 35 entering that season. 13 players since 1982 have had 12+ sack seasons between the ages of 32 and 34. They have averaged 7.9 sacks a year since then, and have averaged 6.8 sacks in the year they turned 35.

Teams know this and are unlikely to pay a player who will produce 7-8 sacks a season for three years (on average) more than $8,000,000 when the talent pool in the NFL grows ever-richer, especially for pass-rushers. They especially won’t pay that much after the rush of free agency and the draft is well over.

In fairness, the landscape of a new cap in the expanding NFL will make it easier, making an $8,000,000 salary look more like $6,250,000, but it seems to be an unusual move to make for a player who would be projected to produce average results with no upside. This is the sort of money that Brian Robison (8.5 sacks a year in the last three years), Terrell Suggs (9.3, adjusted for games played in the last three years) and Jason Babin (10.8 sacks) received. All of them produce more and are expected to produce more than the average 35-year-old pass rusher that had at least one 12+ sack season has.

A team that needs a pass-rusher could very easily draft one for much cheaper, and pass-rushers are relatively easy to draft (compared to other positions). Between 2006 and 2010, 24 of the 66 pass-rushers drafted in the first four rounds (40%) are of the quality to consistently produce eight sack seasons (compared to other positions, ranging from 15-20%). More than that, general managers will always think that the pass-rusher they just drafted will produce at a better rate than an aging veteran, which matters more in contract negotiations anyway.

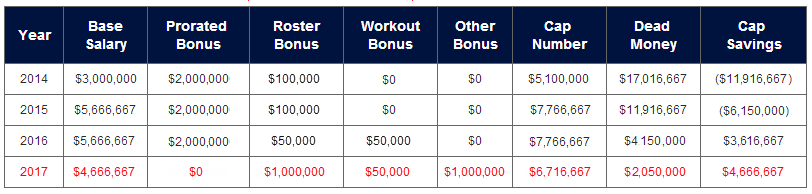

The better move for Allen would be to take a signing bonus and grab less total money so that it would be more difficult for the Bears to cut him in years three and four. Naturally, it would be impossible to determine if the Bears would agree to such a contract, but here’s an example contract that is fairly standard for veterans, but includes a player option (much like the one Cassel had in his) if Allen determines that the market won’t be favorable to him.

This is a contract worth $27,350,001 that would likely give Jared more total money (assuming the first two years are guaranteed) in the long run than his current $32,000,000 contract, while still remaining (somewhat) friendly to the Bears. In this scenario, Allen has the ability to pick up a player option in year four (highlighted in red) if he thinks the market won’t offer him more than $6,666,667. If he thinks it will, he will decline the option and negotiate an open salary worth whatever it is he thinks he can get.

This is the worst case, most conservative scenario of an alternate contract given that he was the one asking for the void in the contract and made a sacrifice in order to get it (and also because there were five teams, at least, negotiating for his services).

In a world where he gets 12.0 sacks (or more) in 2014, but 4.0 sacks in 2015 and 3.0 sacks in 2016, he will get no money under his current contract in 2017 (and would not likely find a new suitor for more money). In the hypothetical contract above, the Bears will have to figure out whether or not cutting him in that scenario is worth freeing up $4.67 million in cap space. It likely won’t be, as the cap space will be humongous (as Allen is already banking on) and he can earn under 4% of the available cap space as a situational pass rusher (or retire and cost the Bears nothing if playing time is really that important to him).

If he doesn’t get very high sack totals, the effect on his total earnings wouldn’t be different under either contract as he would only get $15,500,000 under the current contract and $14,800,000 in the hypothetical contract (because he would be cut).

The Bears would gladly pay him $8,000,000 in the fourth year if he produces a 12.5 sack season and two seasons of 8.0 sacks or more. But it is unlikely that many teams will pay him more because of his age, meaning if he hits the market because of the void in his contract, he could return to the Bears for a reduced price. Alternatively, with a different contract, he has leverage and a backstop—teams would have to pay him at least the player option price to get him (likely more). Not so with an automatically voided contract.

The only scenarios where Allen would get more money under the current contract than the hypothetical contract above are ones where he consistently produces 10+ sack seasons, and the difference is marginal. In his current contract, if he breaks 12.0 sacks in 2016 while also producing 10.0 sacks in 2014 and 2015, at least one team will pay him $8,000,000+, meaning his four-year earnings will probably be something like $35,000,000 (for an $11,000,000 contract).

In the hypothetical contract under the same scenario, he earns $32,000,000 instead of the $35,000,000.

But if he produces three 11.0 sack seasons, he would earn $32,000,000 in the old contract and $32,000,000 in the new contract (assuming he declines the option and negotiates a near $11,000,000 salary).

Which means the only way he makes more money with the current contract is if he not only has at least one 12.0-sack season, but two other seasons good enough to convince teams that the season that triggered the void was not a fluke. In nearly every other scenario, he earns more money with a contract that has a smaller total.

The odds of that are low. There are 14 players who have had 100+ sacks in their first ten seasons in the NFL. Of those inactive, the average number of sacks after those players’ tenth seasons was 7.0, and those careers lasted 3.75 years longer. In fact, on average, the best sack total they achieved after year ten was 9.6, rarely hitting the 10.0 mark. Only two of them produced more than one 10+ sack seasons (Bruce Smith and Reggie White), and there were only 13 seasons in total of those 45 seasons that had at least 10.0 sacks, and 3 more had at least 8.0 sacks.

Only one player produced three consecutive 10+ sack seasons after his tenth year: Bruce Smith.

Jared Allen needs to be Bruce Smith in order to earn more money with this contract than an alternative contract with less “total money” in it. If he’s Simeon Rice or Greg Townsend (Rice produced 3.0 sacks over two years and Townsend produced 9.5 over three years), the second contract is better by far.

Should he produce average numbers for a post-10th season rusher, like Lawrence Taylor or Leslie O’Neal, that second contract pays him more because the Bears likely wouldn’t cut someone who can still produce 7.0 sacks, at least as an interim rusher for less than 4% of the cap.

If he does what he plans to do and hits 12.5 sacks a season in those three years, he’ll be a 35-year-old pass rusher on the market looking for work and won’t likely make the $8,000,000 the Bears would be potentially willing to pay him if he doesn’t void his contract. And if Allen doesn’t hit 12.5 sacks, he likely also didn’t hit enough sacks to convince the Bears to pay him anyway.

A deal that offers him protection from one subpar year (only two rushers didn’t have a “subpar” year, which I defined as below 8.0 sacks, in those three years) would be far better, even if it is only a small amount of protection. People (and teams) have strong default preferences, so if Allen shows enough to allow the Bears to rationalize the last year of his contract, they will usually do it knowing that some form of a hit will still penalize them.

Again, it’s hard to tell if the Bears would have accepted that deal, but given that he was deciding between the Jets, Raiders, Seahawks, Bears and Cowboys, there was likely one team that would have been able to meet these or similar reduced terms while still providing Jared a better overall haul in terms of money.

This is all knowing that Allen’s pass rushing has dropped off in recent years while he’s been declining and in particular, his pass rush ability has been going south:

Jared Allen’s total Pro Football Focus grade has been declining, as has his pass rush grade, per the @PFF twitter account

That it takes him more snaps than anyone else in the NFL to grab that many sacks should also be somewhat of an indication, though of course that is somewhat of a choice he personally makes—to wait to use his best moves to take advantage of the tendencies he’s established.

If you removed 2011 as an outlier year, the fact of Jared Allen’s decline goes from speculative to obvious. It’s hard to tell if that’s the truth, but Jared Allen is fighting history and his own convenience even if it isn’t.

Jared assumes (or is at least risking) that he will automatically be worth more than $8,000,000 in 2017 if he gets one season with 12.0 sacks, even though there is a good chance that even with a 12.0 sack season the market will be bare (once more, especially because all the free agents have been signed and the draft already happened)—he won’t get anything if the other two seasons are poor, and he would get a similarly good deal under a different structure if the seasons are good anyway.

And remember, Allen voids his contract, removes any leverage he has and could return to the Bears for a reduced price if he has 12.5 sacks in a season and does merely “OK” in the other seasons.

Or, put differently—under the current contract, if Allen has:

- three great seasons, he earns $35,000,000.

- a good season and two OK seasons, he earns $28,000,000.

- three OK seasons, he earns $32,000,000.

- a good season and two bad seasons, he earns $24,000,000.

- two bad seasons right off the bat, he earns $12,500,000.

But under a hypothetically lower contract, if he has:

- three great seasons, he earns $32,000,000.

- a good season and two OK seasons, he earns $28,750,000.

- three OK seasons, he earns $29,500,000.

- a good season and two bad seasons, he earns $27,500,000.

- two bad seasons right off the bat, he earns $21,700,000.

If you’re willing to play odds and say that there is a 2.5% chance of the first event, 10% chance of the second event, 25% chance of the third event, a 50% chance of the fourth event and a 12.5% chance of the last event, then the payout of the first contract is $25.2 million while the second is $27.5 million, despite the fact that the second contract is nearly $4.5 million “below” the first contract—an enormous reduction.

If Allen took a $30,000,000 deal with a similar structure, then the difference is nearly $6 million in the expected outcomes of his real contract versus a reduced, but better structured deal—again, something he could have likely extracted from one of the five teams that were negotiating with him.

And if he took the Denver contract that DeMarcus Ware took, he would have the following numbers:

- if he has three great seasons, he earns $41,000,000.

- if he has a good season and two OK seasons, he earns $38,00,000.

- if he has three OK seasons, he earns $36,500,000.

- if he has a good season and two bad seasons, he earns $30,000,000.

- if he has two bad seasons right off the bat, he earns $23,000,000.

For an “expected” outcome of $31.8 million.

Because Jared asked for this void to be in the deal, he likely sacrificed in order to get it. Meaning that the most likely deal was a similar total with someone else that would have an “expected” contract outcome of $33 million or so, a difference of $8 million or more.

Allen’s overconfidence may have lost him a lot of money.

EDIT: I should clarify that Jared Allen wanted the void in his contract and took a purposefully worse contract to do it. It’s not that other teams didn’t offer him a contract with less total money (teams would jump at the chance to get him for four years at less than $7 million a year! Are you kidding me!?) that was structured in a way that would protect Allen. It’s that Allen negotiated away a chance at a long-term contract because he thinks he could outperform it. The other deals I’m highlighting are deals that teams would rather have for their players.

You must be logged in to post a comment.